2017 Market Review in Ten Charts

Alphaliner in its weekly newspaper took a look on the shipping markets in 2017.

src="/files/fa/news/es/Thumbnails/0249cdea-74ec-49c1-b4c2-ace8ac2f9ce1_260_199.jpeg' class='img_convert' title='2017 Market Review in Ten Charts' alt='2017 Market Review in Ten Charts'>

According to MANA correspondent cited by Aplphaliner, shipping industry and its performance analysis have been surveyed in 10 different sections which are shown by charts.

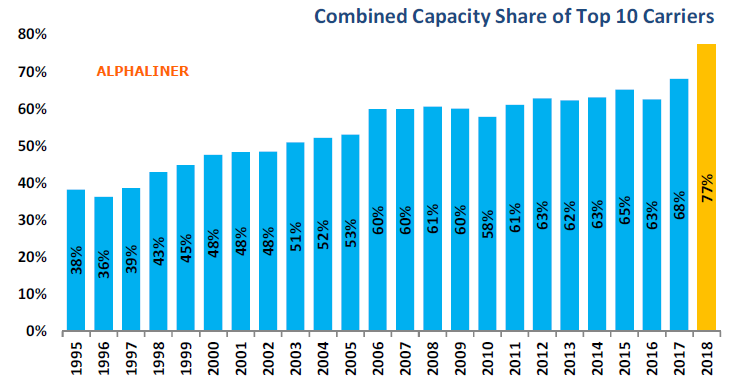

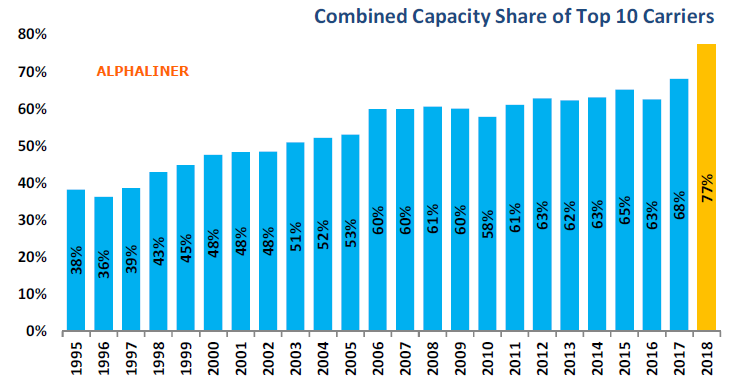

(1) Industry concentration at all time high

Industry consolidation has continued apace in 2017, capped by the completion of the Hapag-Lloyd acquisition of UASC in May and Maersk’s acquisition Hamburg Süd at the end of November. Increased market concentration is reflected in the chart below which shows that the combined capacity share operate by the Top 10 carriers has reached a new record high of 77% at the end of this year. This figure is set to increase further to reach 82%, with the impendin absorption of OOCL by COSCO and the merger of K Line, MOL and NYK to form ‘Ocean Network Express’ (ONE).

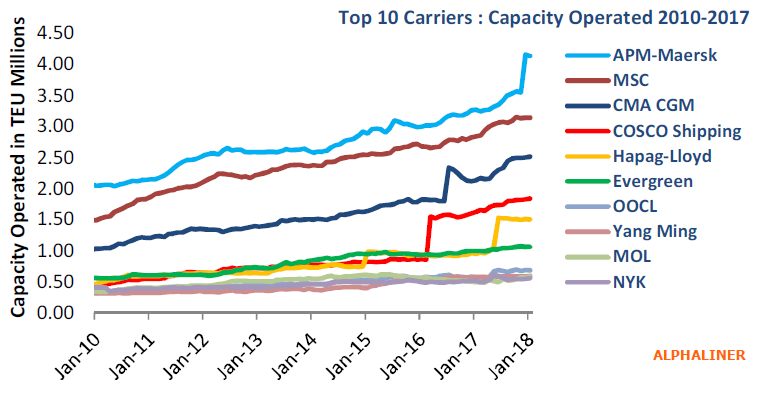

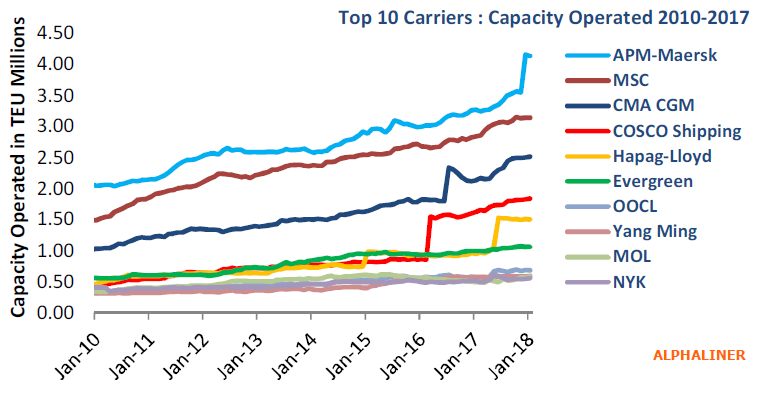

(2) Top 3 Carriers retain market positions

Maersk, MSC and CMA CGM retained their respective positions as the top three carriers in the global operator rankings, but COSCO and Hapag-Lloyd have closed the gap though consolidation moves in the last two years. COSCO is expected to leap into the number three spot once it completes the acquisition of OOCL early next year.

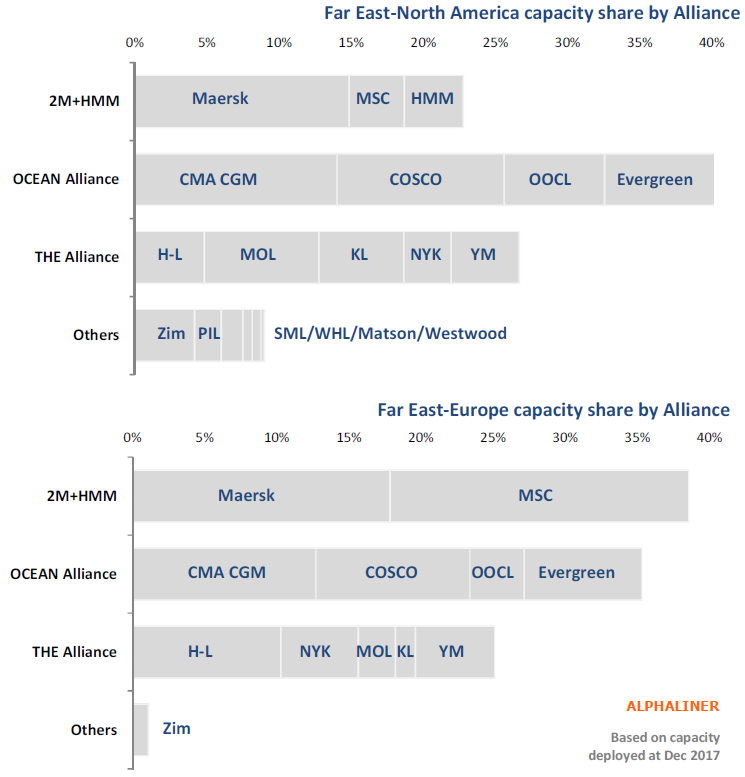

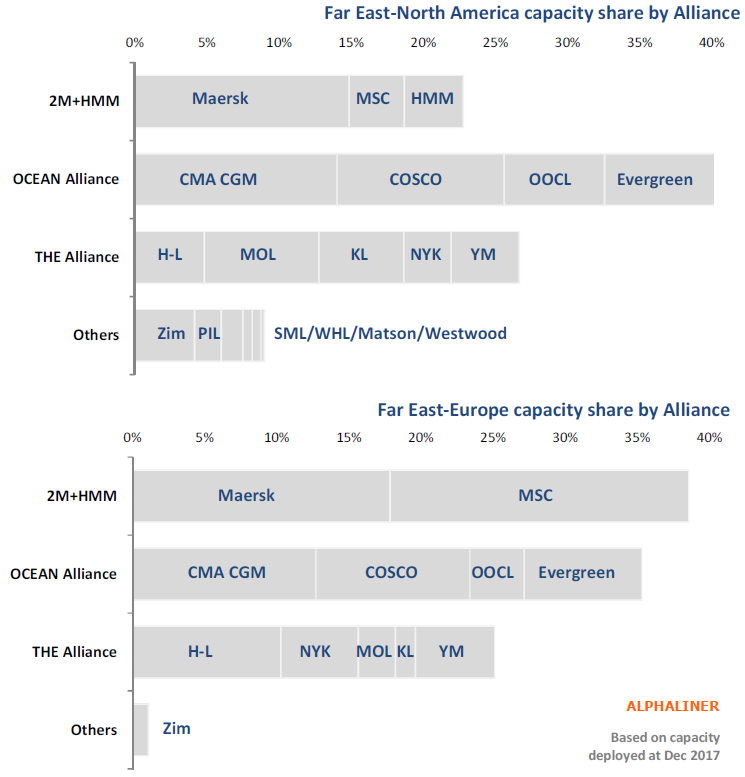

(3) New Alliances dominate East- West trades

The reshuffling of the former 2M/G6/ CKYHE/O3 alliances led to the formation of new Alliances, officially launched on 1 April 2017.

The three new Alliances, 2M+HMM, OCEAN Alliance and THE Alliance, currently control 91% of the Far East - North America trade capacity and 99% of the Far East

- Europe trade capacity.

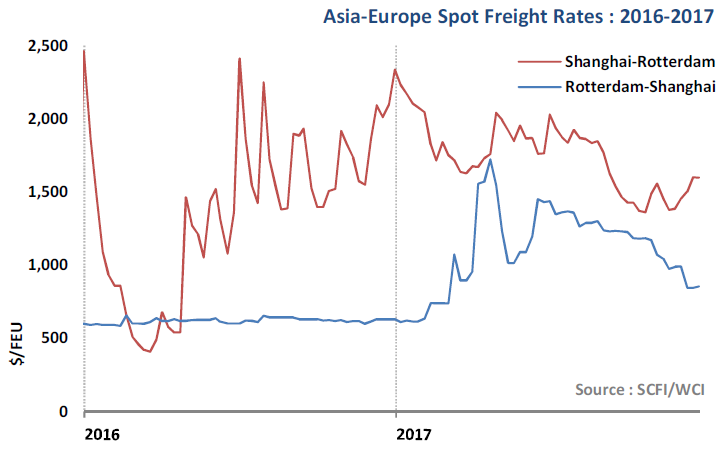

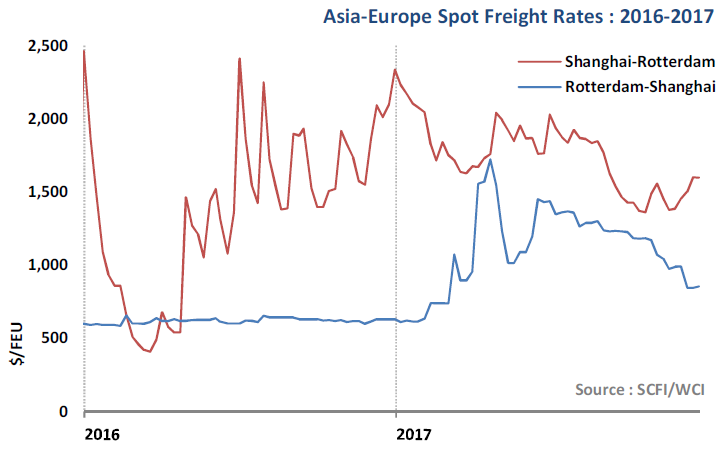

(4) Backhaul rates hit record high while headhaul rates fail to retain 2H 2016 gains

Backhaul spot rates on the Europe - Asia sector hit a record high in April 2017, due to equipment and space shortages. These shortages were amplified by the ongoing transition to the new Alliances on 1 April.

While backhaul rates have lost most of their gains since the second-quarter rally, rates still remained 38% above their 2016 average, as at the end of December.

Headhaul spot rates have lost ground, erasing all of the gains made since September 2016, with industry consolidation failing to prevent carriers from resorting to rate cutting.

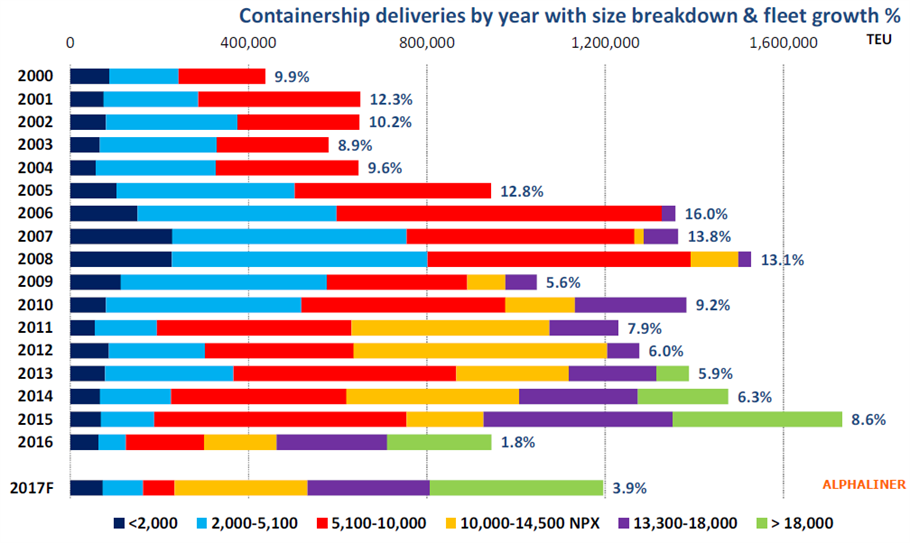

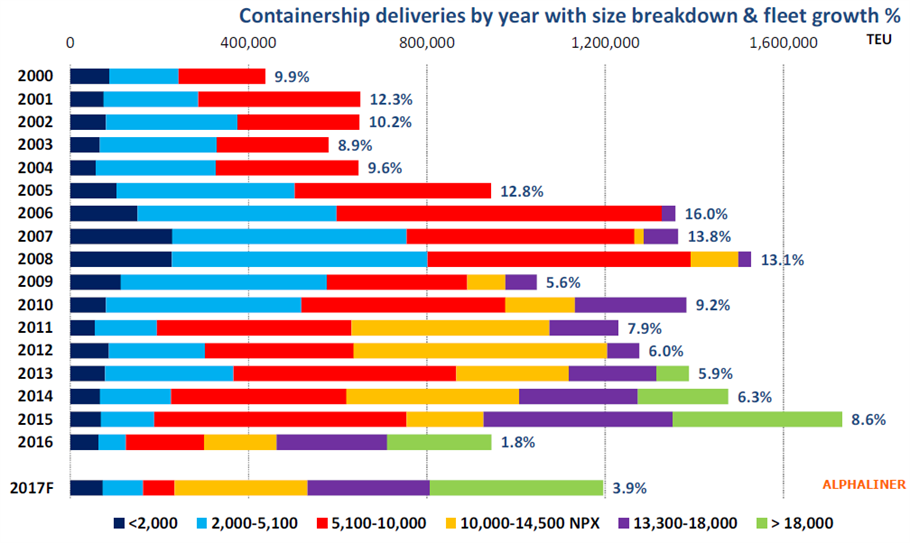

(5) ULCS dominate new vessel deliveries

Containership deliveries reached a total of 1.19 Mteu in 2017, 26% more than in the year before. Ultralarge containerships of 14,000 teu or larger accounted for more than 55% of this new capacity.

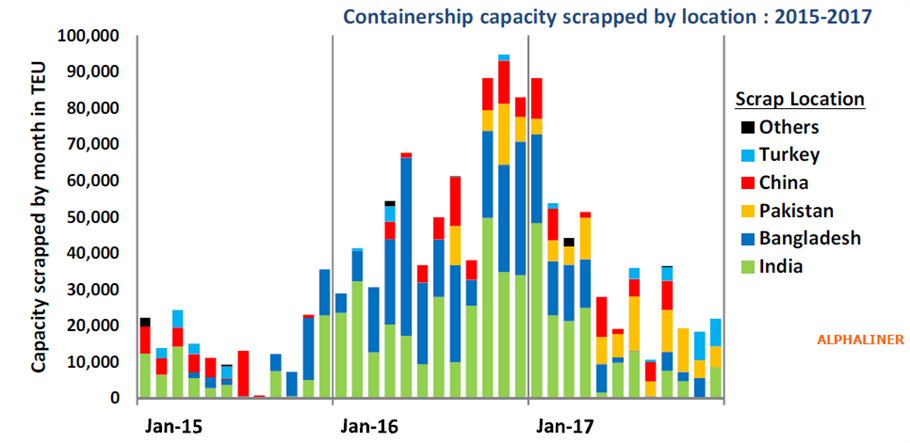

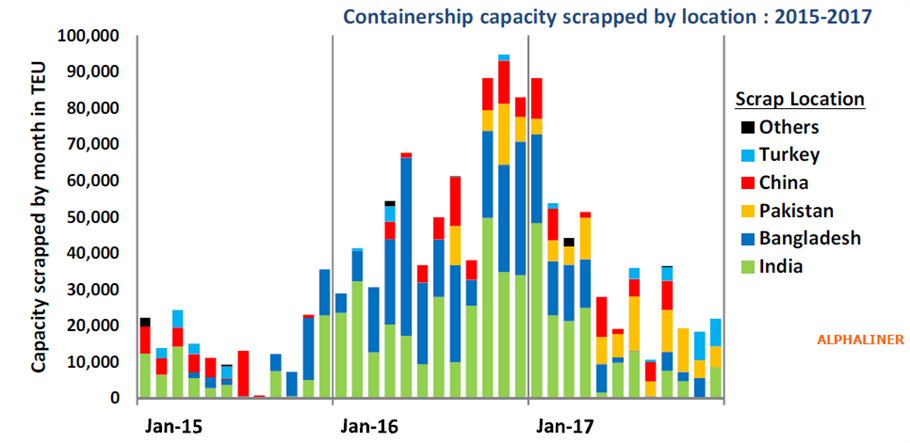

(6) Scrapping slows from 2016’s frenetic pace

The 2017 fleet capacity growth rate was twice as high as in 2016, when a year-on-year growth of 1.8% had been recorded. Apart from the effect of numerous large containership newbuildings that join the world fleet, this higher net growth comes partly due to a lower ship breaking activity. Vessels capacity scrapped in 2017 reached 427,250 teu, compared to 675,500 teu in 2016.

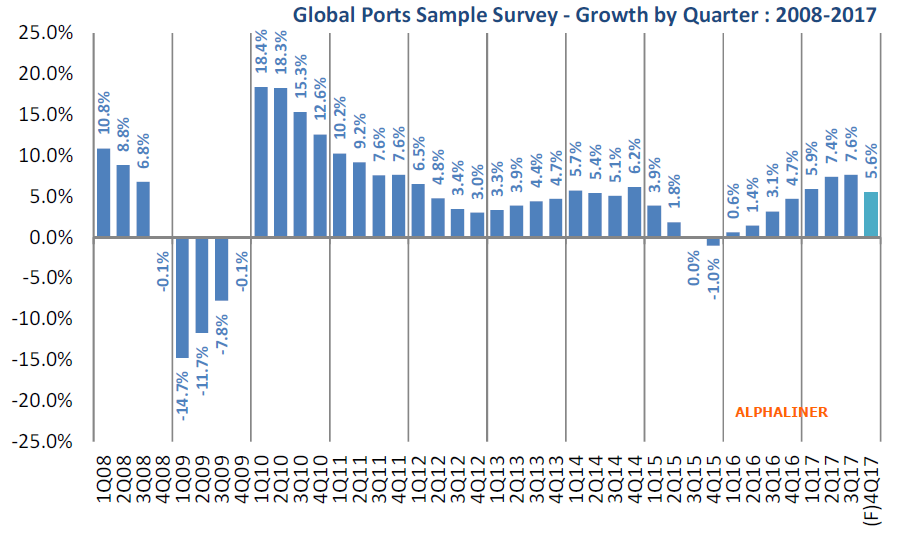

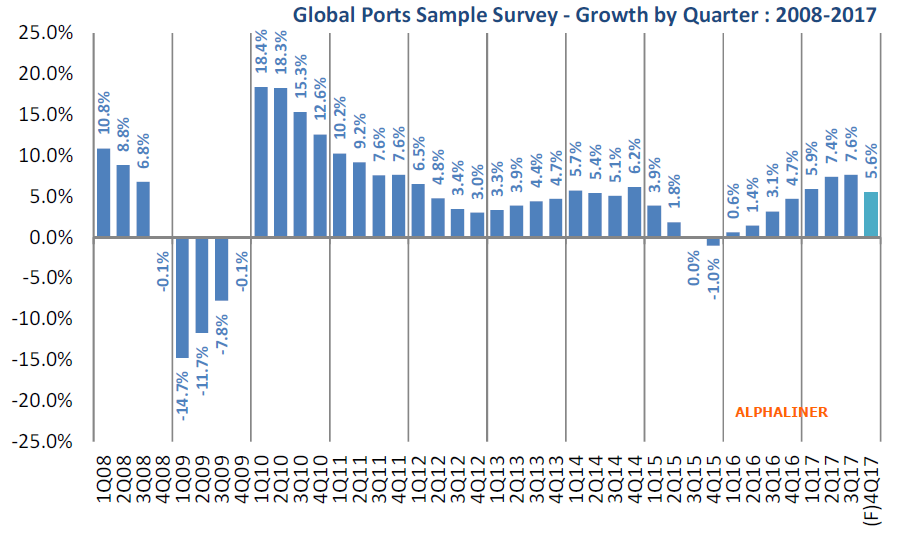

(7) Demand growth rebounds

Global container throughput has recovered strongly in 2017, growing by an estimated 6.5% during the year - in its strongest showing since 2011.

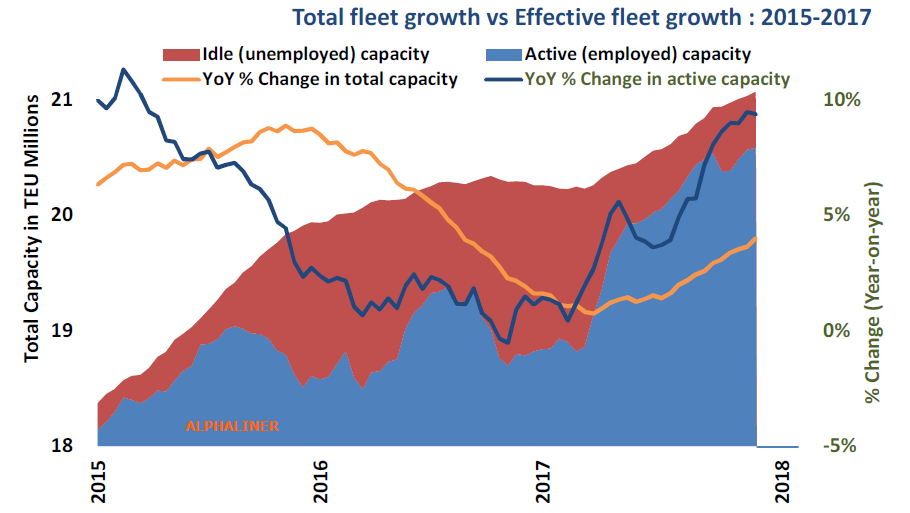

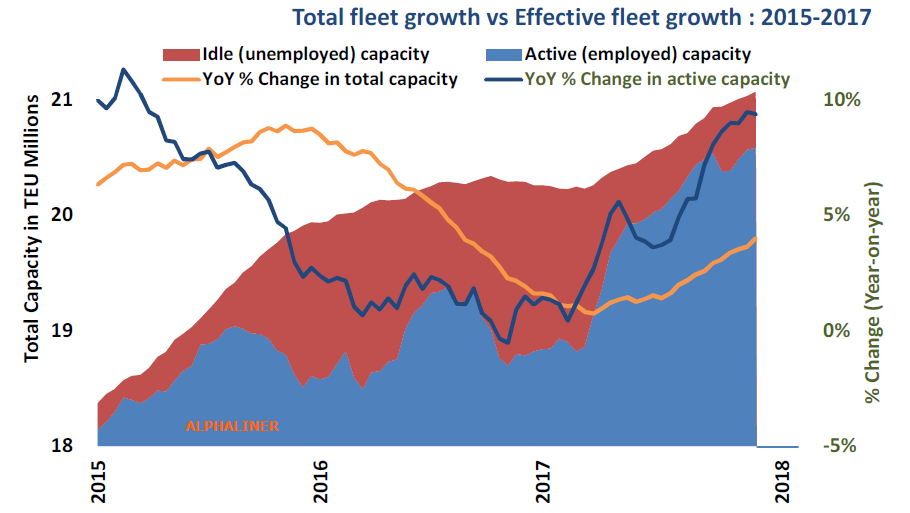

(8) Effective supply growth outpaced demand growth

Although the nominal container fleet capacity grew by ’only’ 3.9% in 2017, effective capacity growth reached 9.5% in December 2017, after accounting for the idle fleet’s reduction.

Carrier’s inability to rein-in the effective growth in fleet capacity, has been the main reason for the shipping lines’ failure to prevent freight rates from falling from their peaks of early 2017.

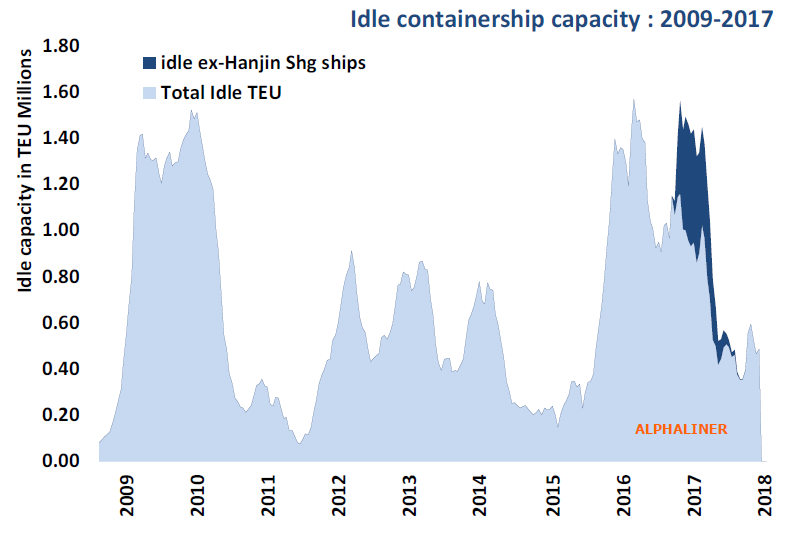

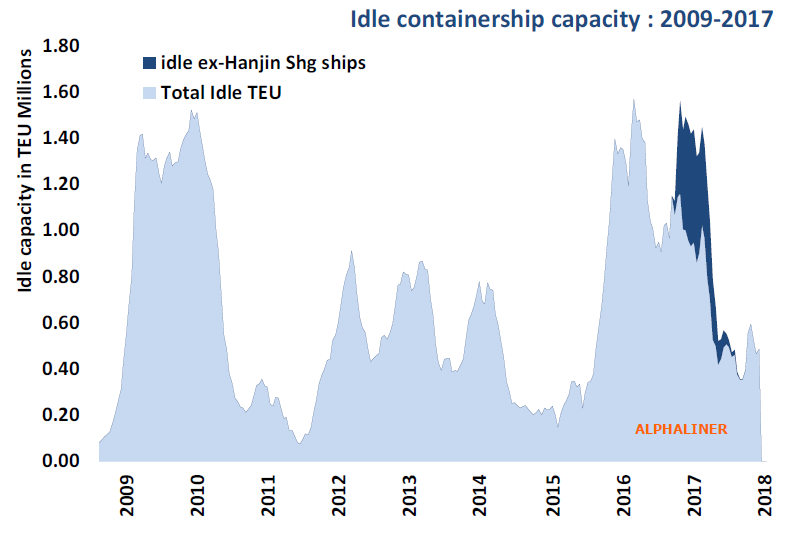

(9) Capacity overhang still not

fully cleared Although the idle containership fleet has shrunk to 0.49 Mteu in December 2017, compared to 1.44 Mteu a year ago, it still accounts for 2.3% of the total global fleet.

A large part of the reduction in the idle fleet has its origins in the return to active service of much of the former Hanjin Shipping fleet.

In the period from late 2016, after the Korean carrier’s failure, until September 2017, some 0.50 Mteu of hitherto idle ex-Hanjin capacity has been absorbed by other carriers.

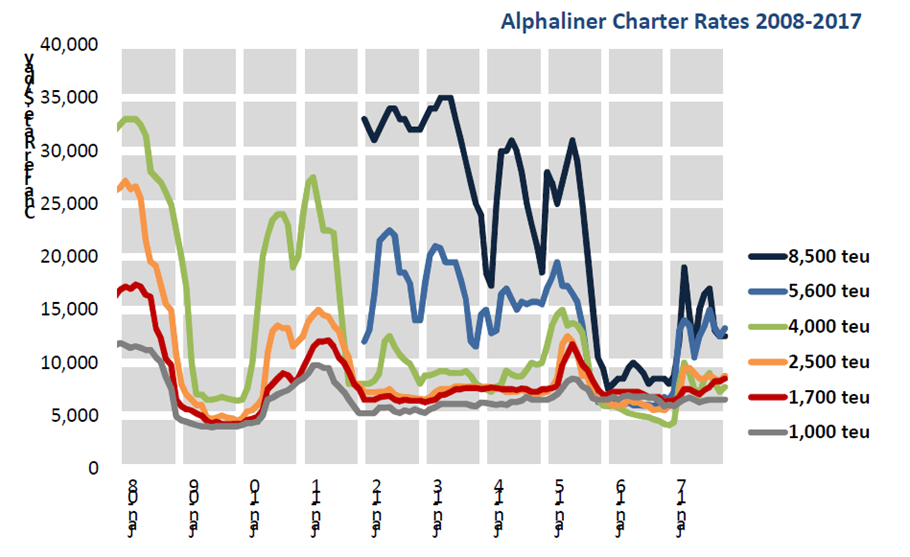

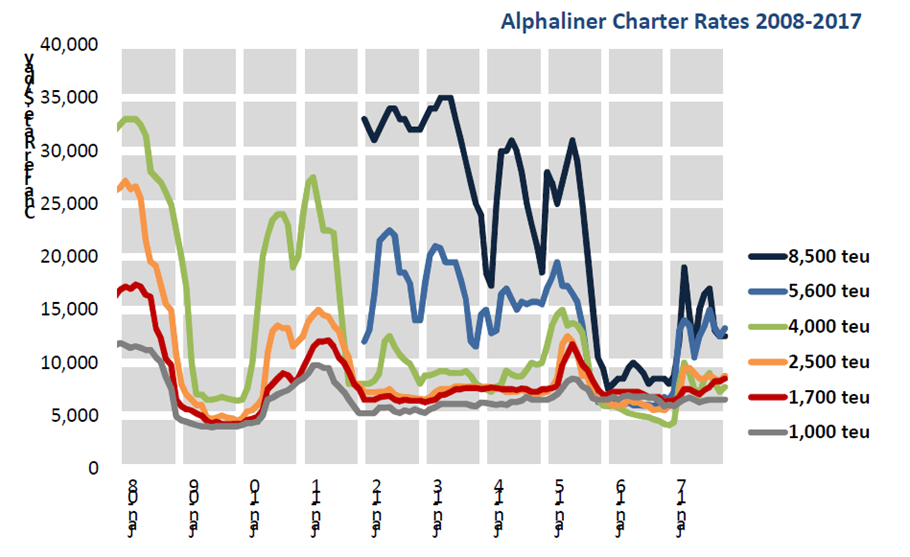

(10) Charter rates rebounds from 2016 lows but challenges remain

The continued overhang of idle ships has continued to weigh down on charter rates, even though stronger vessel demand has nudged containership charter rates up from their 2016 lows. Charter rates remain less than remunerative for most non-operating owners, and they currently stand some 42% below their historical 20-year average.