Return of Iranian Ports in the Post-Sanction Era

Since enactment of JCPOA, the return of Islamic Republic of Iran as an indispensable player in international trade and global economy has given rise to a thrilling move throughout the world.

src="/files/fa/news/es/Thumbnails/4e9e0043-4474-4639-8b52-fca358aaa590_260_199.bmp' class='img_convert' title='Return of Iranian Ports in the Post-Sanction Era' alt='Return of Iranian Ports in the Post-Sanction Era'>

Iranian economy at a glance

Until August this year, 350 commercial delegations and 160 political ones have been visited Iran from five continents, and the number is still growing fast. These delegations have made hundreds of agreements and contracts on economic cooperation, trade, investment, and business development. At the same time, 60 states have recognized the right of Iran’s membership in WTO; and in spite of some encumbrances, international consensus has been formed around the need to reestablish trade and economic ties with Tehran.

Islamic Republic of Iran is an outstanding figure in terms of geo-economics and geo-politics. As the largest nation in Middle East and Central Asia, Iran is an economic powerhouse in terms of international trade, industry and agriculture, energy and natural resources, science and technology, tourism and logistics. In spite of all unprecedented global pressures in the past three decades, Iran is the land of resources and opportunities. Among the great features of Iranian economy, we can point to:

• 80 million populations with progressive improvement of human development (HDI reported to be 0.766 in 2014)

• Highly developed human capitals in form of young educated workforce

• Second global place in terms of natural gas reservoirs (34,020 billion cubic meters) and third in terms of production (184 billion cubic meters in 2016)

• Fourth global place in terms of proven oil reservoirs (158,400 million barrels) and sixth in terms of production (projected production of 3.797 million barrels per day of crude oil on average monthly basis within the coming six months)

• 7 percent share of mineral reserves in the world (aluminum, copper, Zinc, magnesium, chrome, lead, sulfur, talc, gypsum, phosphates , cement, silica, gold, uranium, titanium, gem stones, and many more)

• Significant industrial production in more than 40 industries including metals and alloys, automotive, petrochemicals, petroleum refinery, defense, chemicals, food and drinks, pharmaceuticals and healthcare, construction, transport, tourism, retail, shipbuilding, power, telecommunication, electronics, and so on

• Great agricultural production (classified among the top 40 countries in 12 categories out of 13 categories of agricultural products) with an estimate of 47.7 billion USD agricultural production in 2015.

• Foreign trade including 32,495 million USD non-oil exports, 53,652 million USD petroleum exports and 51,560 million USD imports in 2014.

Many of mentioned figures, though still significant in stature, reflect the induced contraction in Iranian economy within the duration of globally-enforced economic sanctions. Indeed, the real capacities and capabilities of Iranian economy are far beyond this projection. This is the main reason for the rush of global economic players to Iranian markets in the advent of post-sanctions era. As appreciated by specialists and researchers, opening of Iran’s mega-market to foreign investment can provide new investment opportunities with estimated value of 600-800 billion USD within the next decade. It is a fact that Iran’s role in global economy cannot be overlooked: the world needs Iran as much as Iran needs the world. The time has come for the world to deal with Iran as a global player and regional partner that is willing to contribute to peace, stability and development. In this paper we review the status of Iranian ports sector and the benefits that it can offer to world trade. We will focus more on container ports that are capable of serving various supply chains.

Iran: the potential crossroad of trade

Iran is geographically located in the intersection of Central Asia, Middle East, and South Asia. It borders 16 countries by land, water and sea1. In this sense, Iran is the second state in terms of number of neighbor countries. Iran has 890 kilometers of coastline in her north that covers the entire southern bottom of Caspian Sea, and 4900 Kilometers of coastline in her south that covers the entire northern expanse of the Oman Sea and Persian Gulf. The Oman Sea is connected to the Indian Ocean, the most strategic ocean in the world. Associated with a total 2.5 billion population in her littoral states, Indian Ocean provides access to emerging and booming economies of new millennium and their markets.

Iranian Territory

Accordingly Indian Ocean has evolved into the greatest maritime highway for transport of energy and trade that attracts half of the container ships, two thirds of the oil tankers, and one third of the bulk carriers in the world. The linkage of Persian Gulf and the Sea of Oman to Indian Ocean provides the connection of Central Asia and Middle East to the global maritime transport network.

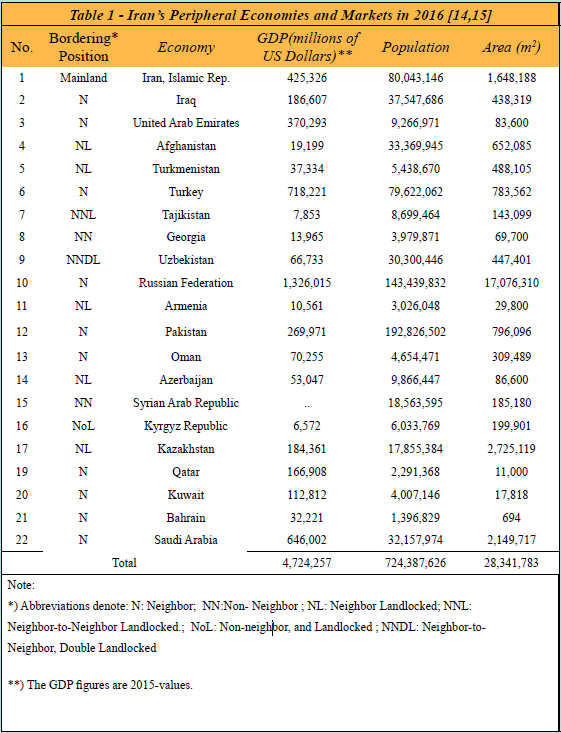

Indeed all of the northern, western and eastern neighbors of Iran can be accounted as her potential hinterlands: Afghanistan, Turkmenistan, Azerbaijan, Armenia, Nakhchivan, and Kazakhstan are landlocked and do not have access to open seas.

There are also landlocked states that are not direct neighbors of Iran, but border her neighbor states: these include Tajikistan, Kyrgyzstan, and Uzbekistan. In spite of access to open seas, states like Iraq, Pakistan, and Syria not only have serious issues in terms of availability of port facilities and infrastructure, but also face serious national security issues. As the most politically stable and logistically capable country in the region, Iran is the best choice to serve the trade to these states.

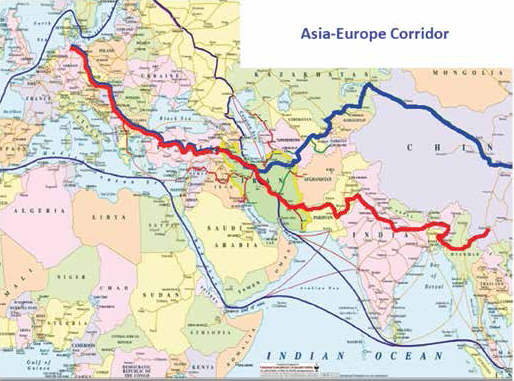

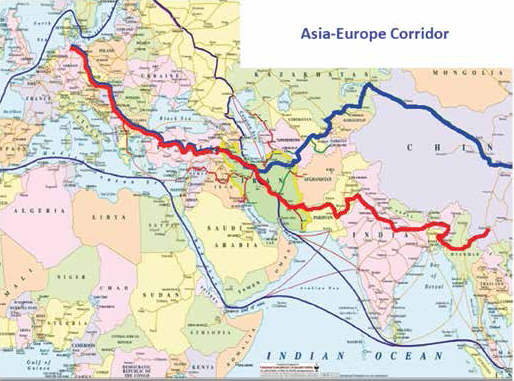

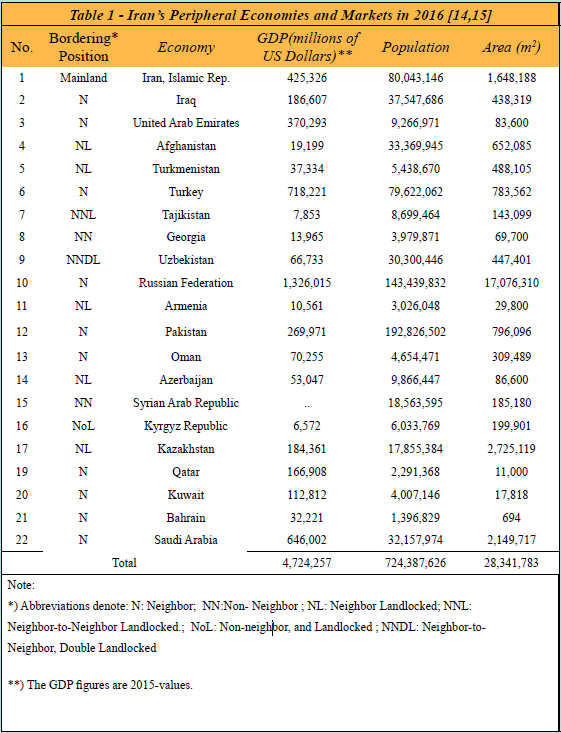

Iran is also the best route for transit of trade flows from South Asia (and Far East) to states like Georgia, Turkey, westbound Russia, Ukraine, and even further to the EU states. The potential transit capability is usually recognized as proposed Transport Corridor concepts. Iran is also incorporated in several other proposed corridors (as shown in exhibit1), including North-South Corridor (NSTC), Europe-Caucasus-Asia Corridor (TRACECA), and Silk Road Corridor. In 2016, the total population of the 17 hinterland states of Iranian ports in Eurasia and Central Asia has been 670.6 million people with an aggregate GDP of 3,325 billion USD (in 2015).

In the south, Iran borders six countries of (Persian) Gulf Council, and Iraq by sea. These are emerging markets and Iran not only has good ties with them but also has substantial trades with UAE, and Iraq, and a scope of emerging trade with Oman. The Persian Gulf Council states are mostly oil-driven economies with total GDP of 1,398.5 billion USD and aggregate population of 53.8 million people in 2016 (excluding Iraq).

Iranian Ports: the natural choice

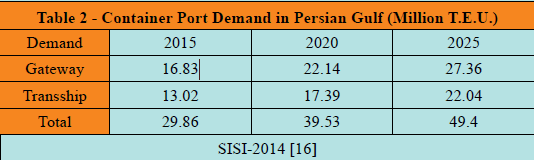

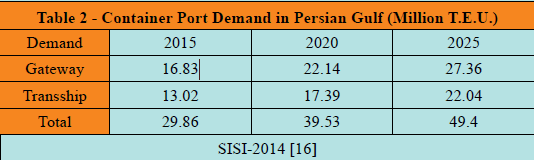

Shanghai International Shipping Institute has forecast that within the coming ten years, the demand for container ports in Persian Gulf will grow (by a 65.44% increase) to 49.4 million TEU. According to this report, we can estimate that the transshipment /gateway traffic ratio will rise from 77.36% in 2015 to 80.55% in 2025. This is on the contrary to the natural tendency of shipping and supply chains towards increase of gateway traffic in ports. Indeed, aside from some few instances, ports are normally driven by gateway traffic all around the world, and a/m ratio is usually near 43% (accounting 30% share for transshipment in total port traffic). This natural tendency has been extravagantly breached in the Persian Gulf. Instead of directing the supply chains to gateway ports to minimize the cost, time, and unwanted externalities (including pollution, and natural resources depletion) in delivery of goods to customers in the markets, the industry has switched into transshipment of goods from remote ports on the west side of Hormuz Strait at extra-heavy costs.

For a better understanding, let’s consider two scenarios: in the first scenario, a shipping line sends a 12,000 TEU ship to Jebel Ali in her Middle East Service, and a big part of cargo is transshipped to Bandar Abbas by two smaller 4,500 TEU Ships.

In the second scenario, the shipping line sends the 12,000 TEU ship directly to Bandar Abbas. By comparing of costs and externalities of these scenarios, we find that scenario number 1 will require and entail consumption of 1134.2 tons of more fuel, emission of 3534.3 tons of CO2, several days of delay in delivery of goods to customers, thousands of dollars of additional cost per delivery of each container, and hundreds of thousands of dollars for deployment of ships per voyage. This is absolute diseconomy in management of supply chains. These costs and externalities could be pragmatically avoided if the 12,000 TEU vessel was sent directly to Bandar Abbas according to scenario number 2. Unfortunately what has been put into practice for decades is scenario number one.

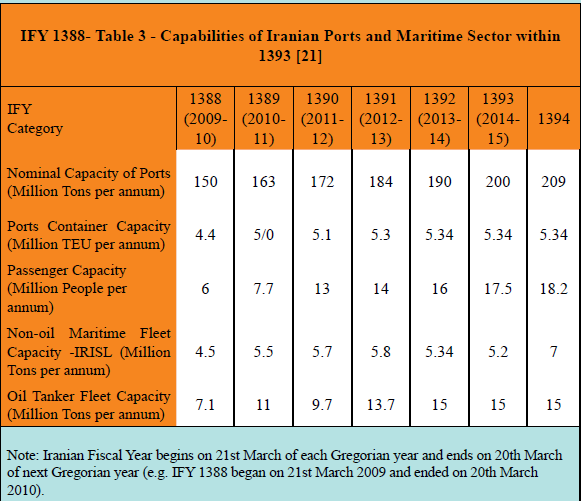

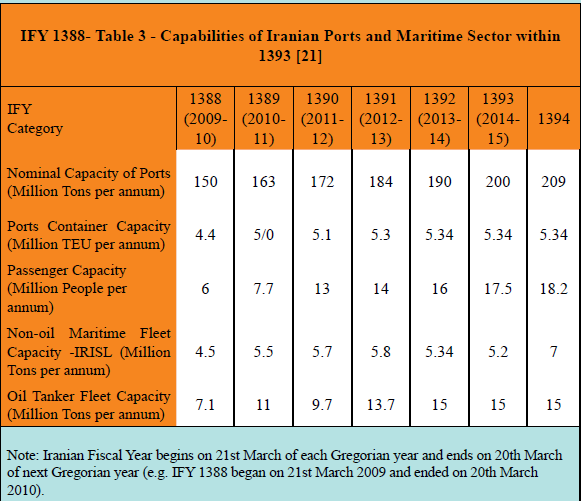

Presently, the Iranian ports sector is capable of channeling one-third of the prevailing gateway container demand in the Persian Gulf region. Table 2 indicates the capabilities of Iranian Ports and Maritime Sector from March 2009 to March 2016. Among the 22 container ports in the Persian Gulf and Sea of Oman, Iran has 6 globally renowned ports namely Chabahar, Shahid Rajaee, Bushehr, Assaluyeh, Imam Khomeini, and Khoramshahr. These ports are connected to a network of about 85893 Kms of roads, 10407 Kms of railways, 60 airports, and supported by great transport fleets3 that can channel and distribute the cargo to inbound and peripheral outbound markets. Moreover on the northern borders, Iran has three major ports that cover the entire southern coastline of Caspian Sea: these are Anzali, Amirabad, and Noshahr. These ports can act as forelands for other Caspian Sea ports (i.e. Baku, Astrakhan, Aktau, Turkmenbashi, etc.). Many of the Iranian ports are involved in development and capacity extension plans: Shahid Rajaee is meant to extend her capacity to 8 million TEU and 150 million tons in a few years. Chabahar has absorbed foreign investment to serve the Southern Asia- Central Asia trade in very near future. Bushehr is developing a 600 thousand TEU container terminal in Negin Island, and there are similar developments in BIK, Khoramshahr, Anzali, Amirabad, and Noshahr. Moreover, many infrastructure development projects are being completed to enhance the connectivity in Iranian transport network: these consist of 11,584 kilometers of roads, 586 kilometers of freeways, and 4,371 Kilometers of railways. Many of these projects are meant to serve as parts of transport corridors that cross Iran, including Qazvin-Rasht-Astara railways, Arak-Kermanshah-Khosravi railways, Anzali-Rasht-Ramsar Freeway, Tabriz nBazargan Freeway, Astara-Rezvanshahr highway, and many more.

The easing of the sanctions is bringing back a breakthrough momentum to the Iranian port sector: So far, 17 container shipping lines have restored their services to Iranian ports. Global and International Terminal Operators (e.g. APMT, DPW, PSA, EUROGATE, HPH and others) are bidding to get involved in the development and concession of Iranian ports and terminals. Being seen as the gateway to their domestic and foreign markets, the Iranian ports are magnetizing the states in their forelands and hinterlands towards them: indeed, they have garnered a great number of agreements in the transport sector and ports between Iranian government and states like the Netherlands, South Korea, Belgium, Germany, India, Oman, Pakistan, Italy, France, Kazakhstan, Russia, China, and many more.

In merchant shipping, IRISL and NITC are among the few shipping lines in the world that are investing heavily in development and recuperation in terms of the prevailing bearish maritime markets. Currently known as the 21st largest shipping line in the world, IRISL is planning to extend her fleet by ordering 579,000 TEU of containerships, 2-million DWT of dry bulk vessels and 1.6-million DWT of tankers, all to be operational by 2020. Also NITC, the owner of the third largest oil tankers fleet in the world, is seeking to invest 2.5 billion USD to modernize her tankers. With all these in coming years, Islamic Republic of Iran will be one of the greatest contributors to maritime transport. This will come into synergy with the capacities and capabilities of the Iranian ports.

According to Strategic Studies and Investigation Center of Iranian Ports and

Maritime Organization, the demand for maritime trade through Iranian ports will be growing largely in the coming 10 years. Estimates of PMO indicate that the demands for maritime trade will grow from 150-million tons in the current year to 327-million tons by 2025 (the figures are aggregate sum of estimated demand for maritime trade of oil and non-oil goods). In other words, within a decade we will have a 118% growth in demand for maritime trade in Islamic Republic of Iran. This figure can reveal the prospects of Iranian ports sector and the colossal developments needed for it.

The Iranian territory includes the Strait of Hormuz. The strait not only accounts for the passage of 35 percent of oil traded by sea, but also facilitates the crossing of around 85,500 vessels per year. This provides the best opportunity for development of maritime business clusters in Iranian territory. The based on cluster may include such businesses as bunkering, maritime insurance, ship repair, salvage, ship chandlery, and many more businesses. The best instance of such businesses is bunkering: according to vicinity to maritime routes, economic supply of oil products, and availability of infrastructure and equipment which makes, Iran among the best choices to build a stable bunkering market.

Iran has been working actively to enhance her trade and business environment. Many Iranian ports have been transformed into free zones and special economic zones. Several exemptions, discounts, and facilitations are in place to support the transit from Iranian land. Iranian state is an influential member of many economic blocs such as Economic Cooperation Organization (ECO), GECF and OPEC. Iran is also invited to join Eurasian Economic Union (EAEU), Shanghai Cooperation Organization (SCO), and is currently bidding to join WTO as well.

In a nutshell, Iran is moving speedily to gain her merited position as a global participant in economy, international trade, and logistics in the post-sanction era. This can be a turning point in the history of the Middle East. Expanded from the heart of the Heartland to the edge of the Rim-lands, Iran is the natural choice of ports and terminals in the Middle East. This preference is strongly substantiated by political stability, industrial development, human development, size of accessible markets, transport facilitation, and opportunities for cooperation and investment. The time has come for the world and Iran to recognize the interests of one another and organize their joint efforts to consolidate them.

By : Mehdi Rastegary

Head of Research and Development Affairs, Sina Marine and Ports Services Co.